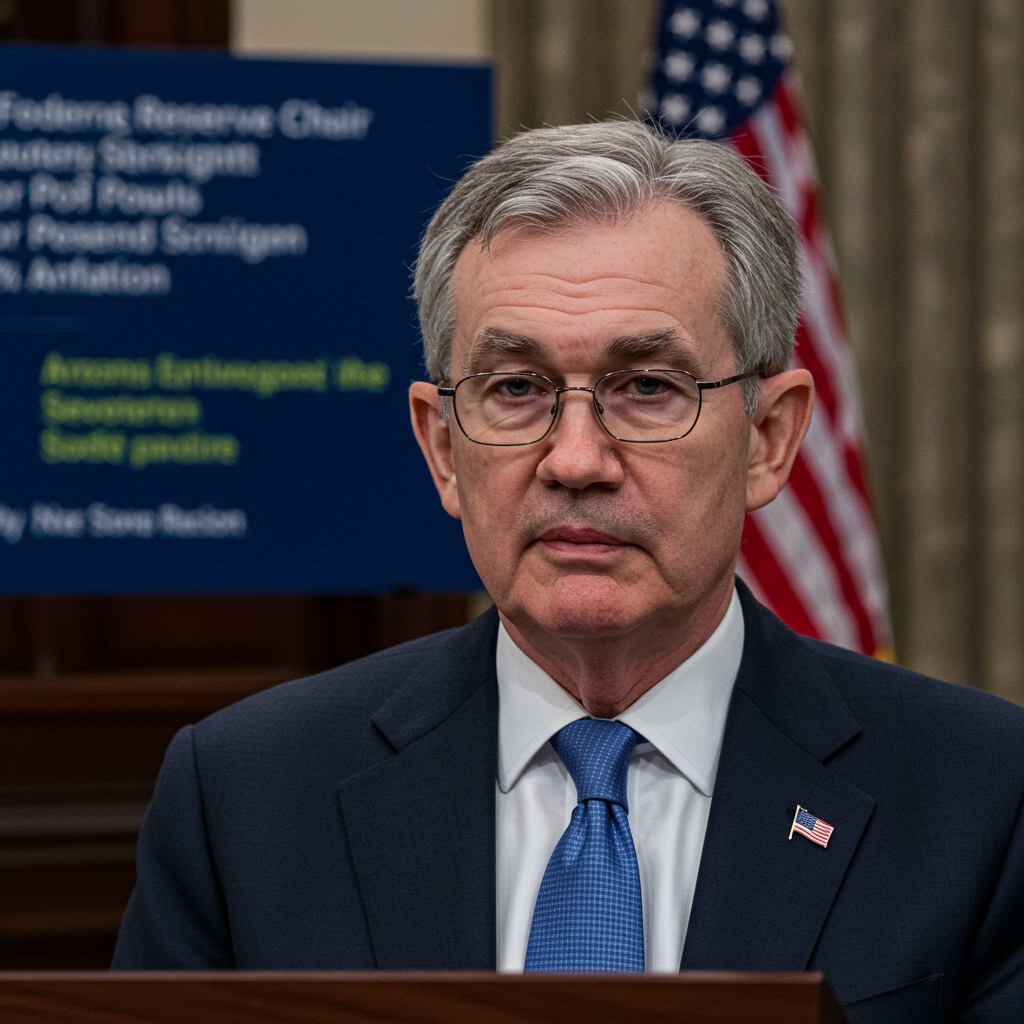

The financial world is intently focused on the Federal Reserve following recent comments from Chairman Jerome Powell, hinting at a potential shift in the central bank’s monetary policy trajectory. Speaking in the aftermath of key economic data releases, Powell indicated that the Federal Open Market Committee (FOMC) is taking a hard look at the persistence of inflationary pressures, a stance that marks a notable departure from previous, more dovish pronouncements.

Economic Landscape: Q1 2025 Data

This recalibration of the Fed’s rhetoric comes on the heels of two significant economic indicators. Firstly, the Gross Domestic Product (GDP) figures for Q1 2025 were released, showing the US economy grew at an annualized rate of 1.8%. While growth remains positive, this figure reflects a moderation compared to previous quarters, suggesting some cooling in economic activity. Secondly, and perhaps more critically for the Fed’s immediate concerns, the latest Consumer Price Index (CPI) data was published. The CPI report revealed that the annualized rate of inflation is holding stubbornly at 3.9%. This figure remains significantly above the Federal Reserve’s long-term target of 2%, raising questions about the pace of disinflation in the economy.

Chairman Powell’s Commentary

During a press conference following the data releases, Chairman Powell addressed the economic situation and the FOMC‘s current thinking. He acknowledged the 1.8% GDP growth in Q1 2025 and the persistent 3.9% annualized CPI rate, framing them as central to the committee’s deliberations. While deliberately avoiding any firm commitments or setting a specific date for action, Powell’s language signaled a heightened level of concern regarding inflation’s tenacity. Crucially, he stated that a potential interest rate hike at the upcoming June meeting of the FOMC “remains on the table” if subsequent economic data points do not show clearer signs of inflation moving decisively towards the Fed’s target. This phrase, “remains on the table,” is being interpreted by analysts as a clear signal that the central bank is actively considering tightening monetary policy again, should current trends persist.

The Rationale: Persistent Inflation Concerns

The primary driver behind the Fed’s potentially more aggressive posture is the continued elevated level of inflation, as underscored by the 3.9% CPI reading. Despite previous rate hikes intended to cool the economy and reduce price pressures, inflation has not retreated as quickly or as consistently as the FOMC had hoped. Persistent inflation erodes purchasing power, impacts the stability of the economy, and can become embedded if not addressed. Chairman Powell’s comments emphasize that the central bank is “closely monitoring persistent inflationary pressures,” indicating that they are looking beyond single data points at the underlying trends and components contributing to the overall price level. The worry is that factors such as strong wage growth, supply chain issues, or elevated consumer demand are keeping inflation anchored at a level incompatible with long-term price stability.

Implications for Markets and the US Economy

The prospect of another interest rate hike, particularly one signaled after a period of relatively stable policy expectations, has significant implications for financial markets and the broader US economy. Higher interest rates directly impact borrowing costs for virtually all economic actors. For consumers, this means higher costs for mortgages, car loans, and credit card debt. For businesses, it translates into more expensive financing for investment, expansion, and operations. These increased costs are intended to dampen demand and slow economic activity, thereby easing inflationary pressures.

Market expectations, which had largely priced in a period of rate stability or even potential cuts later in the year, are now being rapidly adjusted. The potential for a hike at the June meeting introduces uncertainty and volatility. Bond yields are likely to rise as investors demand higher returns to compensate for the risk of future rate increases. Stock markets may react negatively to the prospect of higher borrowing costs impacting corporate profits and economic growth. The value of the US dollar could also strengthen as higher yields make dollar-denominated assets more attractive.

Analyst Perspectives and Forward Look

Market analysts and economists have widely anticipated significant market volatility in response to Chairman Powell’s more hawkish stance. Many had grown accustomed to the Fed’s previous communication, which focused on patience and the cumulative effect of past hikes. The explicit mention of a June meeting hike being “on the table” represents a clear warning shot. Experts note that the FOMC‘s decision will ultimately be data-dependent, hinging on the economic reports released between now and the mid-year meeting. Key data points the Fed will be watching include subsequent CPI and PCE (Personal Consumption Expenditures) inflation reports, labor market data (such as job growth and wage figures), and surveys of consumer and business sentiment.

The coming weeks will be crucial in determining the Fed’s next move. While the 1.8% GDP growth in Q1 2025 suggests the economy is not overheating, the stubbornness of the 3.9% annualized CPI rate presents a clear challenge to the central bank’s mandate of price stability. The possibility of another rate hike at the June meeting, explicitly stated by Chairman Powell, underscores the Federal Reserve’s resolve to bring inflation under control, even if it means potentially impacting economic growth. Businesses and consumers across the US are now bracing for potentially higher borrowing costs as the FOMC weighs its options based on incoming data.