Washington D.C. — The United States Federal Reserve’s monetary policy-setting committee, the Federal Open Market Committee (FOMC), concluded its two-day meeting on Wednesday, May 29, 2025, announcing its decision to keep the benchmark federal funds rate unchanged. The rate will remain within its current target range of 5.25% to 5.50%. This move signals a continued cautious approach by the central bank as it navigates the path toward price stability.

The decision to hold borrowing costs steady comes against a backdrop of recent economic data suggesting a potential cooling in inflationary pressures. Notably, reports on the consumer price index (CPI) for April and early May indicated a moderation in the pace of price increases, offering some encouragement to policymakers who have been aggressively tightening monetary policy over the past two years to curb inflation.

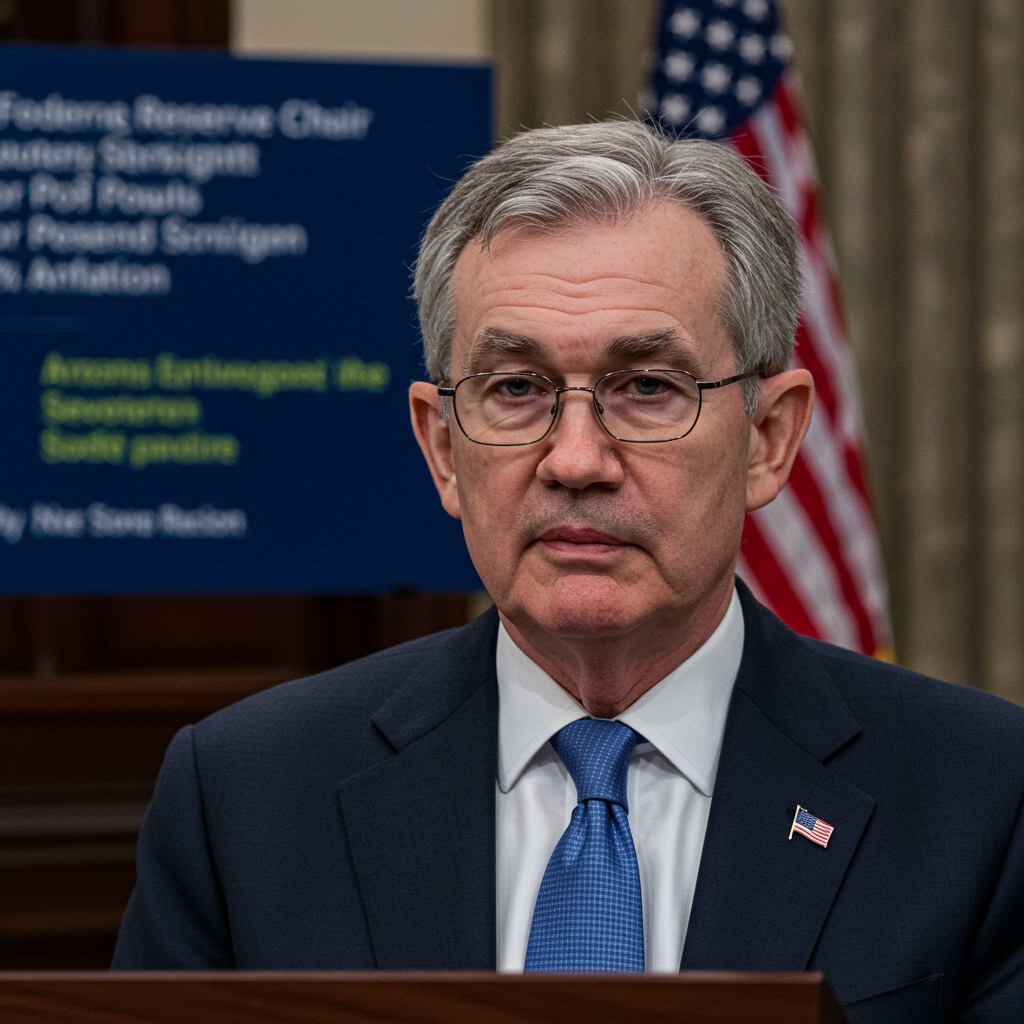

Chair Powell’s Assessment and Forward Guidance

Speaking at a press conference following the meeting, Fed Chair Jerome Powell acknowledged the recent positive developments on the inflation front. “While inflation remains above the Federal Reserve’s 2% target,” Powell stated, “the recent trend is encouraging.”

He reiterated the committee’s commitment to achieving its dual mandate of maximum employment and stable prices. Powell emphasized that despite the encouraging data, the fight against inflation is not yet over, and the path forward remains uncertain. He underscored that the committee will remain strictly “data-dependent,” meaning future monetary policy decisions will be heavily influenced by incoming economic reports on inflation, employment, and economic growth.

Regarding the potential for future policy adjustments, including much-anticipated interest rate cuts, Chair Powell maintained a flexible stance. He indicated that any such moves are “contingent on sustained progress towards the inflation target.” This language suggests that the Fed needs to see consistent and convincing evidence that inflation is reliably moving down to the 2% goal before considering easing monetary policy. The timeline and magnitude of any potential rate adjustments were not explicitly laid out, reinforcing the data-dependent posture.

Committee Unanimity and Economic Outlook

The vote to maintain the benchmark interest rate at 5.25%-5.50% was notably unanimous among the twelve voting members of the FOMC. This rare show of unity suggests broad agreement within the committee on the current strategy of holding rates at their restrictive level while observing economic developments.

The FOMC’s post-meeting statement also included its assessment of the current economic situation. While acknowledging some variability in recent data, the committee generally described the economy as continuing to expand at a moderate pace, with a strong labor market. However, the focus remained squarely on inflation, which the statement characterized as having eased over the past year but still running elevated.

The committee reiterated its view that the risks to achieving its employment and inflation goals are moving into better balance. Nevertheless, the uncertainty surrounding the persistence of inflation and the potential impact of high interest rates on economic growth continues to necessitate a cautious approach.

Market Reactions and Future Expectations

Financial markets had largely anticipated the Fed’s decision to hold rates steady, given recent economic data. The focus now shifts to future economic reports, particularly upcoming inflation and jobs data, which will provide crucial signals for the FOMC’s deliberations at subsequent meetings.

Analysts broadly interpret the Fed’s message as one of cautious optimism tempered by a strong commitment to its inflation target. While the door to potential rate cuts remains open, the timing appears highly dependent on whether the recent moderation in inflation proves to be durable. The unanimous vote suggests that the committee is united in its current holding pattern, awaiting further evidence of sustained progress towards price stability before considering any shifts in policy direction.

The next FOMC meeting is scheduled to take place in late July, at which point policymakers will again review the latest economic data and assess the appropriate stance of monetary policy.