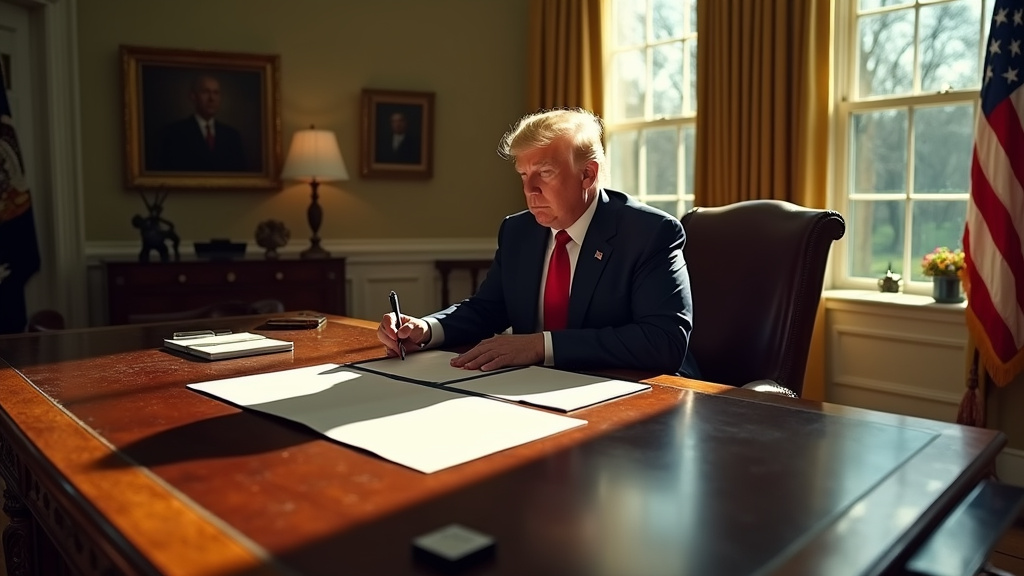

Washington, D.C. — A sweeping legislative package championed by House Republicans, unofficially dubbed the “One Big Beautiful Bill Act” by Newsweek, has advanced one step closer to final passage after clearing a critical procedural vote in the early hours of Thursday, July 3rd, 2025.

The move signals significant momentum for the expansive bill, which includes substantial tax cuts aimed primarily at wealthy individuals and corporations, coupled with significant reductions to key social programs like Medicaid and food assistance. The successful procedural vote in the House follows the bill’s narrow approval in the Senate just two days prior, on Tuesday, July 1st, 2025. That Senate passage required the intervention of Vice President JD Vance, who cast the tiebreaking vote to move the legislation forward.

Navigating the Legislative Path

The pre-dawn vote on Thursday morning was a crucial step in the legislative journey for the controversial measure. Procedural votes, while not the final tally on a bill’s content, are essential for controlling the legislative process, allowing debate to proceed or bringing a measure to a final vote. Clearing this hurdle indicates that House Republican leadership has marshaled sufficient support within their caucus to bring the bill to the floor for what is anticipated to be a high-stakes final vote in the coming days.

House Speaker Mike Johnson has been actively working behind the scenes to secure the necessary Republican votes for the package’s ultimate approval. Achieving consensus within the Republican ranks has been a significant challenge, given the bill’s broad scope and the diverse interests within the party.

Core Provisions and Projected Impacts

The substance of the “One Big Beautiful Bill Act” lies at the heart of the political debate surrounding it. Proponents argue that the tax cuts will stimulate economic growth and create jobs, while the spending reductions are necessary to curb government expenditure. However, critics voice grave concerns about the distribution of the tax benefits and the potential effects of cutting social safety nets.

According to the publicly available text and analysis, the bill proposes significant tax relief measures that disproportionately benefit higher income brackets. Simultaneously, it mandates substantial cuts to programs designed to assist vulnerable populations. Specifically, major reductions are slated for programs such as Medicaid, which provides health coverage to millions of low-income Americans, and various forms of food assistance.

The human impact of these provisions has drawn sharp criticism from advocacy groups and independent analysts. The Kaiser Family Foundation, a non-profit organization focusing on national health issues, projects that approximately 17 million people could lose their health insurance coverage over the next ten years if the bill is enacted as written. This projection highlights the potential scale of disruption to healthcare access, particularly for families relying on public assistance programs.

Fiscal Implications and Debate

The bill’s projected impact on the national debt is another major point of contention. The non-partisan Congressional Budget Office (CBO), responsible for providing independent analyses of budgetary and economic issues, has released an estimate indicating that the legislation would add a staggering $3.3 trillion to the national debt over the next decade.

This figure has fueled intense debate between fiscal conservatives, who express alarm at the rising debt, and proponents of the bill, who argue that the economic growth spurred by tax cuts will eventually offset the initial increase, a claim disputed by many economists. The CBO’s analysis provides a sobering look at the long-term fiscal consequences associated with the package.

What Lies Ahead

With the procedural vote cleared in the House, the bill is now poised for a final floor vote. The margin is expected to be tight, mirroring the narrow passage in the Senate. House Speaker Mike Johnson’s efforts to consolidate support will be critical in the hours leading up to the vote.

The potential passage of the “One Big Beautiful Bill Act” represents a significant legislative victory for Republicans and the White House, enacting policies that could reshape the nation’s tax code, social safety net, and fiscal trajectory for years to come. Conversely, opponents warn of dire consequences for millions of Americans and a substantial increase in the national debt.

All eyes are now on the House as it prepares for the definitive vote on the sweeping package, which could occur as early as later this week, determining the fate of legislation with profound implications for the country.